Coin Promotion: A “high risk” crypto wallet promotion.

Cryptocurrency proponents once peddled the idea that Bitcoin was a strong hedge (aka hedge) against inflation.

When it comes to traditional inflation protection, gold, commodities and even bonds are common trades.

But the idea that Bitcoin is inflation-proof is losing steam.

Here on Stock Power Dailywe don’t buy based on theories.

Our proprietary Stock Power Ratings system helps us cut through the noise and find the smartest investments with the highest potential.

Although our system does not value currencies, it does value the stocks tied to them.

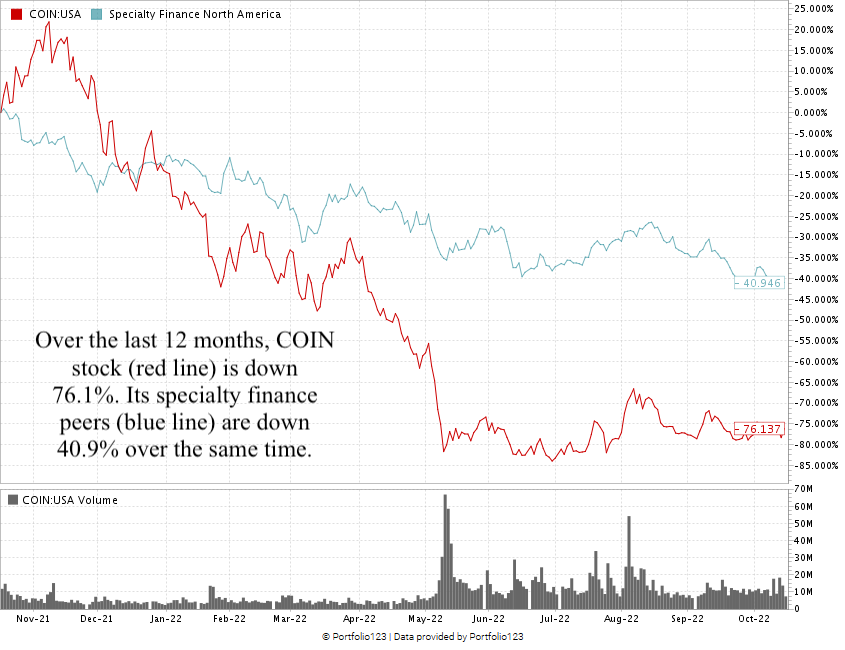

Bitcoin Wallet Provider Stocks Coinbase Global Inc. (Nasdaq: COINS) have fallen by almost 75% since the beginning of the year.

The price of COIN shares follows the same trend as the price of Bitcoin.

And given how much crypto is struggling, this tells us the stock is worth staying away from.

That’s why.

What is Coinbase?

Coinbase is a platform that allows users to buy, sell and use bitcoins and other cryptocurrencies.

The company was launched in 2012 and provides tools that merchants can use to accept Bitcoin payments with a single button.

Our stock strength rating system tells you that investing in this company is risky.

The stock went public in April 2021 with much fanfare amid the popularity of Bitcoin.

As the price of Bitcoin fell from $47,000 in January 2022 to $19,500 in October, so did the COIN share price.

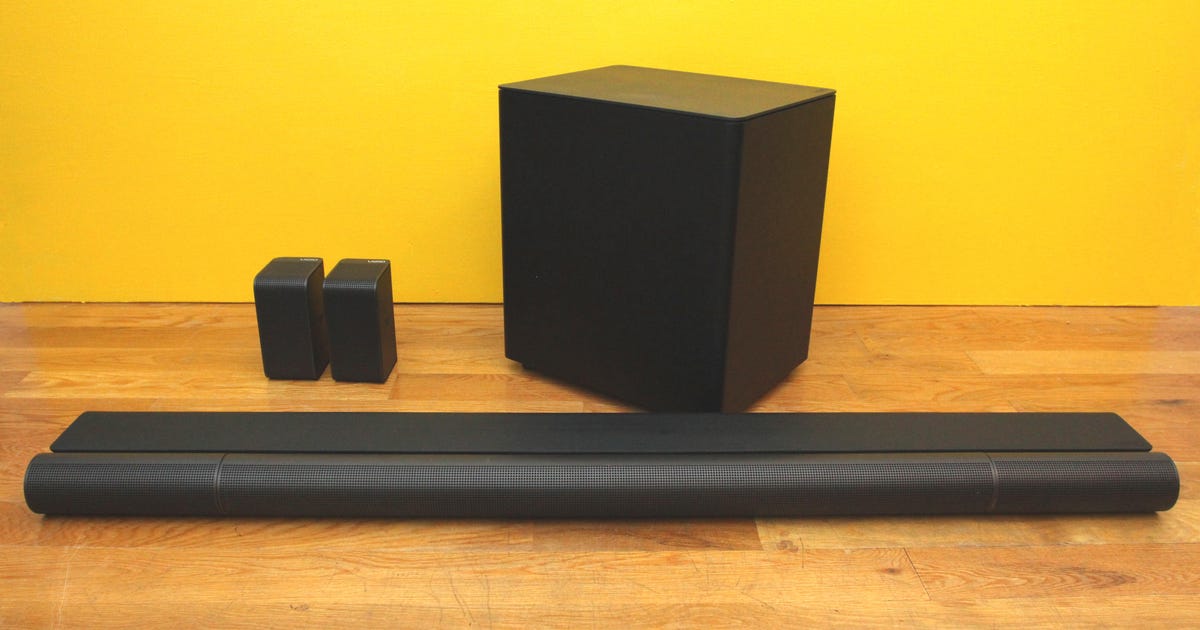

COINSOctober 2022 Stock Power Ratings

COIN Shares Rated “High Risk” 0 out of 100 in our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

COIN Promotion: Low Cost + Weak Momentum

I enjoy sharing exciting findings about our energy reserves.

But this is not the case with COIN:

- In its most recent fiscal quarter, the company reported earnings of $808,325 — a decrease of 60% compared to the same period last year!

- The company reported net income losses totaling $1.1 million. That’s down from $1.6 million in revenue for the same time last year.

This explains why COIN earns a 1 on our growth factor.

It also has disadvantages in other fundamental factors: quality and cost.

COIN’s return on equity is terrible negative 5.1%.

This is even lower than industry peers, which average minus 3.8%.

The company does not record a positive price-to-earnings or price-to-cash flow ratio.

It earns a 13 by value.

These numbers tell us that COIN is not monetizing its client platform.

Created in October 2022.

You can see the COIN drop on the stock chart above.

The stock has fallen significantly over the past 12 months.

During the same time, analogues in the field of finance decreased by 40.9%.

Coinbase Global Stock Valuation a 0 in general in our proprietary inventory power rating system.

This means we consider it “high risk” and expect it to underperform the broader market.

While Bitcoin may be a popular investment, stocks related to the cryptocurrency continue to struggle.

A quick look at our stock strength rating system shows that COIN crypto platform stocks should be avoided.

Stay tuned: The ‘strong beef’ hero of home health care

Tomorrow we’ll be back to square one Stock Power Daily format.

Stay tuned as I share all the details about a “strong bull” home health provider in the US.

safe trade,

Matt Clark, CMSA®

Research Analyst, Money and Markets

PS I’d love to hear what you think about my Stocks to Avoid article today. Was it valuable? Want us to keep sharing high-risk stocks from time to time so you know what to stay away from?

Would you prefer us to share only “bullish” and “strongly bullish” stocks?