Dillard’s ‘Strongly Bullish’ Shares Have Holiday Momentum

Every year my mom took me shopping for a special pair of shoes for the holiday season.

Since at my school it was always for church or some kind of Christmas party, the shoes had to be fancy.

So she took me to Dillard’s.

I spent hours amidst the smell of leather shopping the shoe department for the perfect pair.

And he always found them.

That meant starting the holiday season off on the right foot.

With Nordstrom and Macy’s having big holiday celebrations, I wanted to bring Dillard’s into the mix. (Read my breakdown Macy’s promotions and Nordstrom stock if you haven’t.)

And Dillard seems to have the lead.

Dillard’s Inc. (NYSE: DDS) rates “Strong Beef” 93 out of 100 in our proprietary inventory power rating system.

Let’s see how preparations for the holidays are going.

Dillard’s Holiday Charity Event

Retailers may face challenges ahead, from inflation to a projected slower holiday spending season.

But that doesn’t seem to scare Dillard’s executives, as it has peers in the industry.

The only holiday promotion released by the company itself is for charity. Exclusive Southern life The Christmas cookbook will hit retail shelves.

Dillard’s hope cookbook stir up the holiday spirit with “inventive recipes and page after page of holiday decorating ideas,” according to a press release.

Proceeds from sales will go to Ronald McDonald House Charities, which Dillard’s has been involved with for 28 years.

Instead of making big moves and promotions like Macy’s and Nordstrom, Dillard’s has a more streamlined approach to the season.

But we will have to wait and see.

Let’s take a closer look at Dillard’s rankings.

Stock power ratings and Momentum for Dillard

Dillard’s Stock Price Is ‘Strongly Bullish’ 93 out of 100 in our stock power rating system.

DDS Stock Power Ratings in October 2022.

Dillard’s Exclusive Value (91) and quality (99) factors are worth noting.

The stock is undervalued and will outperform others over the next 12 months.

We can zoom in to see it closer:

Dillard’s rates a 96 on our momentum factor.

Things to note: When looking at momentum, our Stock Power Ratings system considers short-term, medium-term and long-term trends in stocks.

For Dillard’s, we see some upward trends.

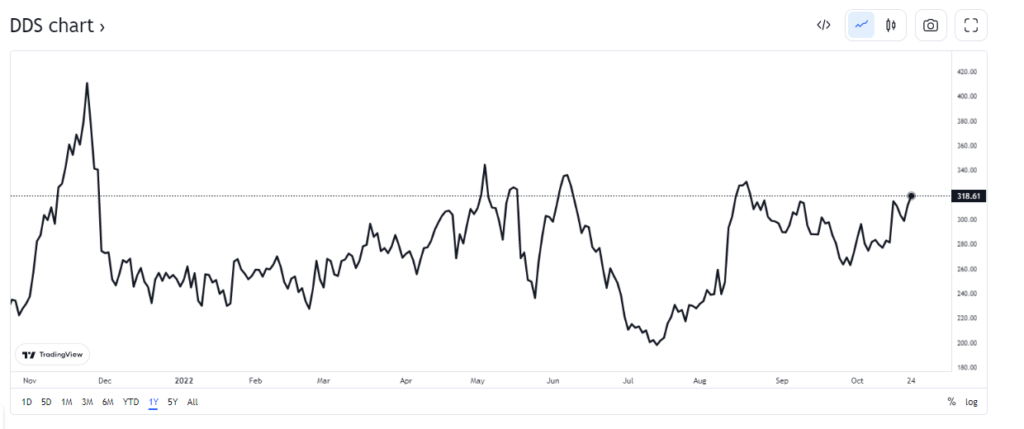

After hitting a 52-week low of $193 on July 13, Dillard’s stock rallied.

Despite a slight dip due to market pressure, DDS is trading at around $319 as of this writing.

That’s a 65% jump!

With no signs of slowing down despite the choppy market, this move gives DDS stock an impressive momentum factor score.

Bottom line

Dillard’s enjoyed ‘strong growth’ 93 out of 100 in our stock power rating system.

This means we expect it to outperform the wider market by a factor of 3 in the next 12 months!

But we have more.

For one highly rated stock you should consider investing in, check out Clark’s goal Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid in our system and tells you why — for free!