Holiday spirit to fight inflation: Nordstrom shares fall in power

When it comes to department stores, I tend to avoid Nordstrom.

Not because I don’t like his products or designers—there are some nice options.

But I’m more comfortable shopping at Macy’s or Dillard’s — maybe even Kohl’s if I have some extra Kohl’s Cash.

Now that could be my insecurity.

Or it could be because Nordstrom has gained notoriety for its upper-class appeal as a high-end department store.

But with inflation hitting Nordstrom as hard as its industry peers, middle-class customers are cutting back on their spending.

Right now, Nordstrom is struggling to meet its sales goals.

Nordstrom Inc. (NYSE: JWN) rated as “neutral” 51 out of 100 in our proprietary inventory power rating system.

As the holiday season approaches, Nordstrom is doing everything it can to win over consumers.

Let’s take a look at some of these plans.

Nordstrom Vacation Plans

Nordstrom and Nordstrom Rack prepare for the holiday season with exciting promotions. Some of these include:

- In-store gift stations with a curated selection of products perfect for refills.

- Boxed gifts priced at $25, $50, and $100.

- In-store events and virtual celebrations featuring special guests such as influencers, interior designers and more.

It looks like Nordstrom is in for a promising holiday season.

But Nordstrom is also among the retailers that have cut the number of seasonal workers from 28,600 in 2021 to 20,000 in 2022.

It shows that Nordstrom is still in trouble despite all these exciting plans.

The shares appear to be an attempt to offset the sharp drop in Nordstrom’s stock that took place in September.

I’ll get into that a bit later when I look at the company’s momentum.

Time will tell how Nordstrom’s stock will affect its sales this holiday season.

In the meantime, let’s take a closer look at his power reserve ratings to see how he is expected to perform over the next 12 months.

JWN Stock Power and Momentum Ratings

Nordstrom Shares ‘Neutral’ 51 out of 100 in our own system.

JWN Stock Power Ratings in October 2022.

Since we’ve focused on Macy’s momentum, I also want to take a closer look at Nordstrom’s to see how it stacks up.

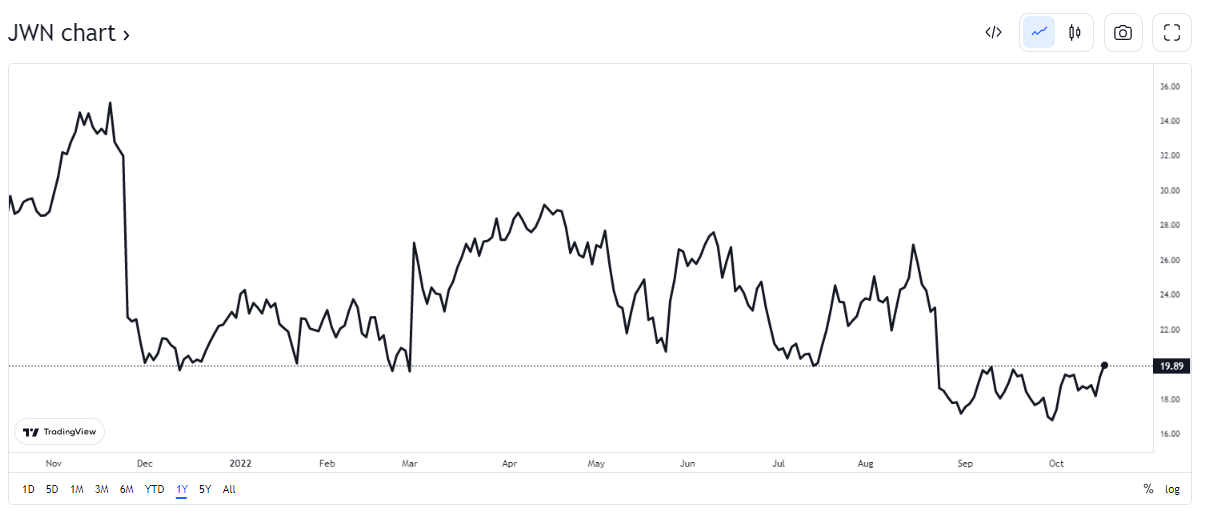

Here’s how Nordstrom stock has performed over the past 52 weeks:

Things to note: When we look at momentum, we consider short-term, medium-term, and long-term trends in a stock.

To get high momentum, we want to see all trends in the positive.

Not so for Nordstrom.

Shares of JWN (red line) plummeted to a 52-week low of $16.14 on September 30.

This shows a short-term downward trajectory for the stock.

Nordstrom Gets ‘Neutral’ 42 on our momentum factor.

Bottom line

Nordstrom Kills “Neutral” 51 out of 100 in our stock power rating system.

Stay tuned for updates: Tomorrow I’ll discuss Dillard’s, which is rated “Strong Bull.”

“Strongly bullish” stocks are not an anomaly.

We expect this stock to outperform the broader market by 3x in the next 12 months!

For one highly rated stock you should consider investing in, check out Clark’s goal Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid in our system and tells you why — for free!